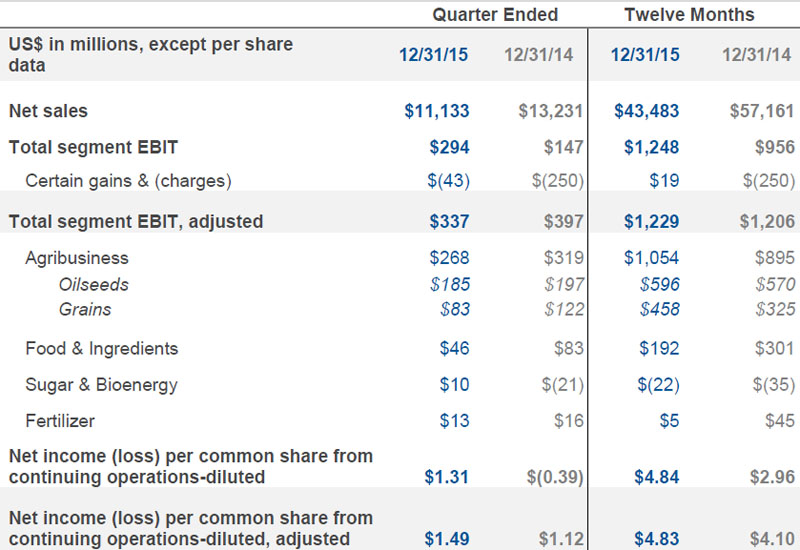

White Plains / NY. (bl) Bunge Limited announced its financial results for the fourth quarter and full year 2015, that ended 31 December 2015. Q4/2015 adjusted EPS increased 0.37 USD to 1.49 USD. Q4/2015 total adjusted segment Ebit is 337 million USD, down 60 million USD versus last year. FY/2015 total adjusted segment Ebit is 1’229 million USD, up 23 million USD versus last year. Combined Agri-Foods trailing four quarter ROIC of ten percent; three points over WACC.

Financial Highlights

Overview

Soren Schroder, Bunge’s Chief Executive Officer, stated, «In 2015, the Bunge team achieved numerous milestones: record Agribusiness EBIT, four quarter trailing ROIC in our core Agribusiness and Food operations of 10 percent and approximately 100 million USD of savings from performance improvement initiatives. We also executed on our balanced approach to capital allocation, buying back 300 million USD of common shares, which has continued into 2016 with an additional 100 million USD of buybacks.

«In the fourth quarter, Bunge managed the challenging market conditions well, leveraging our balanced global footprint to capitalize on good soy processing margins and increased South American grain exports. Food + Ingredients showed slight improvement from the third quarter; however, our Brazilian food businesses continued to struggle in the depressed market environment. Our sugarcane milling operation had its strongest quarter of the year, finishing 2015 with positive EBIT and free cash flow».

«Looking to 2016, there are positive signs. Global demand for our core Agribusiness products continues to grow with an increasing percentage of this growth being supplied by South America, which plays into the strength of our footprint. Brazil is expected to grow large soy and corn crops supporting good crush and export margins, and improved farmer selling in Argentina will allow us to operate our crushing and port assets at higher utilizations. Our food business will continue to grow, benefitting from leaner operations, more focused, consumer-driven innovation and tighter working relationships with key customers. Brazilian ethanol and global sugar prices have both improved. These improvements, coupled with stronger agricultural efficiency and lower costs, give us confidence we will experience a solid year in sugarcane milling».

«But challenges are also evident. Conditions will remain difficult for our Brazilian Food + Ingredients businesses. Northern Hemisphere oilseed processing margins and grain exports will be pressured until markets adjust to the increased level of global supplies».

«We have a solid foundation, as evidenced by the recent solidifying of our credit rating to stable BBB/Baa2, and are focused on the right things: standing for safety, driving best in class performance in our operations, improving our winning footprint through incremental additions, and building our value-added portfolio. We will continue to drive our performance improvement initiatives, generating an incremental 125 million USD of savings in our Agribusiness and Food operations in 2016. We expect a challenging year, but ultimately a year of modest earnings growth and ROIC well above WACC in our core Agribusiness and Foods operations».

Fourth Quarter Results

Agribusiness

Fourth quarter results in Oilseeds were solid, but lower than last year. Soybean processing was higher in Brazil, Argentina, Europe and Asia, driven by higher volumes and margins. Results in the U.S., however, were lower than last year’s record year as margins softened in anticipation of Argentine supply. Softseed processing results were down, primarily due to farmer retention and excess rapeseed processing capacity in Europe. Results in oilseed trading + distribution were lower than last year’s strong performance. Lower results in Grains were primarily due to reduced volumes and margins in our U.S. operation, which was impacted by slow farmer selling and increased global export competition. Partially offsetting this reduction were higher results in our ports + services operations, which benefitted from increased grain exports out of South America and the Black Sea. Our global teams managed risk well during a quarter characterized by falling crop prices and volatile currencies. Lower segment volume was primarily due to decreased grain origination in the U.S. and export flows in our trading + distribution businesses. Volumes in soybean processing, however, were up in all regions. Fourth quarter 2015 results included 23 million USD of charges related to export taxes and fees in Argentina and an impairment of an equity investment in a freight shipping company in Europe.

Edible Oil Products

Segment performance improved from the third quarter, with higher seasonal volumes and the increasing impact of our improvement programs. Results did, however, lag last year, with currency weakness and dampened consumer confidence in key regions weighing on our results. In Brazil, core markets, such as margarines and shortenings, have experienced approximately 6 percent declines in 2015 as consumers bought less and traded down. Our North American Oils business performed well, benefitting from a combination of a more competitive and higher value product mix and increased demand from the key foodservice channel. We also benefitted from increased packaging volumes in Canada and lower industrial costs from our performance improvement programs. While results in Asia were lower, we experienced higher volumes in our core markets of India and China as we continue to see growth in consumer offtake in the overall oils category. In Europe, results were comparable to last year, as new product launches and improved productivity offset challenging conditions in Ukraine and Russia. Fourth quarter 2015 results included 15 million USD of goodwill impairment and restructuring charges in our Brazilian operations. Fourth quarter 2014 results included a 98 million USD expense related to certain value added tax credits in Brazil.

Milling Products

Despite lower segment results, we made significant progress integrating our acquisitions in Mexico, U.S. and Brazil, as well as advancing the rebuild of our world class mill in Rio de Janeiro. Decreased results in the quarter were primarily due to our Brazilian wheat milling business, which continued to be impacted by declining consumer confidence and tightening spend. Volumes and margins were lower from a reduction in consumer demand, particularly in the higher margin food service channel, where industry wheat product volumes are down 19 percent in 2015. In local currency, margins were comparable to last year as our team drove significant productivity improvements. Corn milling results in North America improved from last year, due to lower costs, more optimized product mix and the contribution from our extruded product and masa acquisitions. In Mexico, higher volumes and increased productivity were more than offset by the combination of lower margins and impacts of the weaker peso. For 2015, Mexico wheat milling results where higher year-over-year and in line with our expectations. Fourth quarter 2014 results included a 14 million USD expense related to certain value added tax credits in Brazil.

Sugar + Bioenergy

Improved performance in sugarcane milling was partially offset by lower results in global trading + merchandising and an 11 million USD loss related to our Brazilian renewable oils joint venture. Higher milling results were supported by improved ethanol and sugar prices and sales volumes. Lower SG+A expenses also contributed to the improved performance. For the full-year, milling was both EBIT and free cash flow positive, reflecting improved market conditions and operational performance, as well as disciplined capital management. Fourth quarter trading + merchandising results were slightly lower than last year. Results in our biofuel joint ventures were lower than last year, primarily due to weaker ethanol market conditions in the U.S. and Argentina. Results in the fourth quarter 2015 included 5 million USD of restructuring charges. Results in the fourth quarter 2014 included approximately 113 million USD of impairment charges primarily related to one of our Brazilian milling facilities and approximately 20 million USD of restructuring charges related to improving the cost structure of our operations.

Fertilizer

Results were lower than last year, primarily due to reduced volumes and margins in our Brazilian port operation, which was impacted by reduced imports and currency translation.

Cash Flow

Cash generated by operations in the year-ended December 31, 2015 was 610 million USD compared to cash generated of approximately 1.4 billion USD in the same period last year. The year-over-year variance primarily reflects a higher level of farmer advances due to greater year-over-year farmer selling in South America, which more than offset higher earnings.

Income Taxes

The effective tax rate for the year ended December 31, 2015 was 28 percent. Excluding a total of approximately 16 million USD of certain discrete tax items, the effective tax rate was 27 percent.

Outlook

Drew Burke, Chief Financial Officer, stated, «In Agribusiness, we expect results in Oilseeds and Grains to be largely driven by our South American operations. Northern Hemisphere grain exports and oilseed processing margins, particularly European rapeseed, will be challenged until world supply and demand comes into better balance. This should be helped by the fact that our markets are responsive and global demand for soy meal and soy oil is growing. The USDA is forecasting global soybean meal and oil demand to increase 7 percent and 5 percent, respectively, this year. We expect Agribusiness to start the year slow and results to be weighted toward the second half of the year».

«In Food + Ingredients, we expect higher results driven by approximately 50 million USD of performance improvement related benefits. Recent acquisitions will also contribute to increased performance. While our Brazilian operations will continue to face headwinds, we are optimistic about the outlook of our foods businesses in other regions, in particular U.S. packaging, which should build off its record 2015 performance, and India oils, which is benefitting from strong volume growth and an expansion into higher margin products. We expect segment results to improve sequentially as we progress through the year».

«In Fertilizer, improved farmer economics in Argentina and the removal of export taxes on grains should result in increased purchases of crop inputs».

«In Sugar + Bioenergy, considering our hedged sugar and the Brazilian ethanol pricing outlook, we expect 2016 to be a year of earnings and cash flow growth. We are continuing to manage our milling operation to be self-funding, limiting capital investment to agricultural and industrial maintenance and efficiency projects only. Similar to past years, results will be seasonally weak in the first half of the year».

«Additionally, we expect the following for 2016: depreciation, depletion and amortization of approximately 550 million USD; capital expenditures of approximately 850 million USD, which reflects 150 million USD of investments carried over from 2015; and a full-year tax rate range of 25 to 29 percent».

OTHER TOPICS FROM THIS SECTION FOR YOU:

- LG Chem and ADM: Joint Ventures in Illinois are canceled

- Wendy’s: Company plans to expand into Europe

- Delivery Hero: may face significant fine due to antitrust violations

- Emmi Group: intends to acquire Mademoiselle Desserts

- AB Foods: announces strong H1-2024 performance

- DSM-Firmenich: Queen Maxima inaugurates new dual head office

- RBI: Announces Investments to Drive Growth in China

- Europastry S.A.: puts its IPO process on hold

- McCormick: Reports Second Quarter Performance

- Reborn Coffee: Closes Master License Agreement for UAE

- General Mills: Reports Fiscal 2024 Fourth-Quarter Results

- SunOpta expands plant for processing plant-based beverages

- Britannia: Operating profit grew 10 percent in FY-2023

- Tate + Lyle and CP Kelco to merge to leading global player

- Ülker Bisküvi: announces Q1-2024 financial results

- Europastry: intends to go public on the Spanish stock exchange

- Europastry S.A.: publishes 2023 Annual Report

- Swisslog: announces new Americas region headquarters

- Reborn Coffee: Expanding Omni-Channel Strategy

- Mondelez International and Lotus Bakeries Join Forces