Amsterdam / NL. (tkwy) Just Eat Takeaway.com N.V., hereafter the «Company» or together with its subsidiaries «Just Eat Takeaway.com», one of the world’s largest online food delivery marketplaces, hereby reports its financial results for the first six months of 2022. Chief Executive Jitse Groen: «After a period of exceptional growth, Just Eat Takeaway.com is now two times larger than it was pre-pandemic. Whilst this growth required significant investment, we have continued to focus on executing our strategy to build and operate highly profitable food delivery businesses. Our three largest segments, representing 90 percent of our Gross Transaction Value, were Adjusted Ebitda positive in the second quarter of 2022. Our path to profitability is accelerating and we expect to continue to materially improve our Adjusted Ebitda in the second half of this year and to be Adjusted Ebitda positive at a Group level in 2023.»

Group highlights

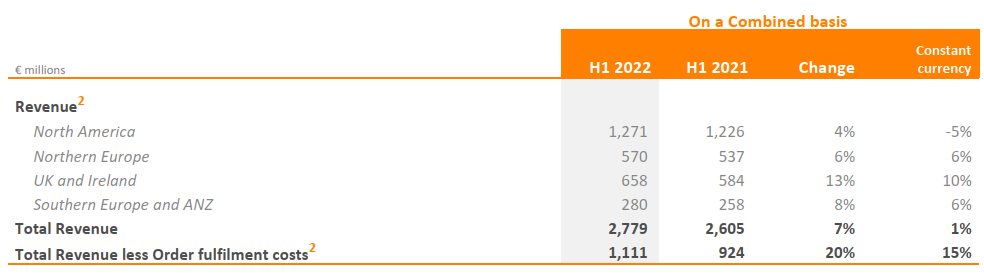

- H1 2021 was a record period for Just Eat Takeaway.com in Order and Gross Transaction Value (GTV) growth due to Covid-19 restrictions and significant investments in Delivery, in particular in legacy Just Eat markets. Exiting the pandemic has resulted in a 7 percent decrease in Orders in H1 2022 compared with H1 2021, which was offset by higher Average Transaction Value (ATV), consumer pricing improvements and positive currency movements, leading to stable GTV at EUR 14.2 billion and strong revenue growth of 7 percent to EUR 2.8 billion in H1 2022.

- In H1 2022, Adjusted Ebitda improved by 29 percent to minus EUR 134 million (minus 0.9 percent of GTV). This year-on-year and sequential improvement clearly demonstrates the path to profitability, both on an absolute level and as a percentage of GTV.

- Northern Europe remained highly profitable, and North America and UK and Ireland were Adjusted Ebitda positive in Q2 as well.

- Further enhancing profitability is one of our highest priorities in 2022. Already actioned improvements will deliver Adjusted Ebitda guidance for 2022, with further initiatives to be implemented in H2 2022.

Segment highlights

- Northern Europe continued to generate significant profits with an Adjusted Ebitda of EUR 124 million in H1 2022.

- In UK and Ireland, Adjusted Ebitda improved 70 percent to minus EUR 18 million in H1 2022. The segment was Adjusted Ebitda positive in Q2 2022.

- Southern Europe, Australia and New Zealand (ANZ) saw notable reduction in losses and with peak investment now behind us, management expects profitability to continue to improve going forward.

- North America was Adjusted Ebitda positive in Q2 2022 and was close to Adjusted Ebitda break-even in H1 2022, despite fee caps in the US and Canada negatively impacting Adjusted Ebitda by EUR 73 million. In July 2022, Just Eat Takeaway.com and Amazon entered into a commercial agreement in the US, offering Amazon Prime members a free, one-year Grubhub+ membership, strengthening Grubhub’s competitiveness in the US market and representing a significant opportunity for growth.

- Brazilian market leader iFood continued to deliver strong growth in H1 2022. GTV grew 23 percent and Revenue grew 28 percent in H1 2022 compared with H1 2021.

Other Financials

- The Company’s cash and cash equivalents amounted to EUR 882 million as per 30 June 2022. The current cash base is sufficient to finance the path to profitability. In addition, management is working on various options to further strengthen the Company’s balance sheet and liquidity position, including potential sale of assets and refinancing alternatives.

- The Loss for the period on an IFRS basis was EUR 3.5 billion, predominantly caused by a goodwill impairment of EUR 3.0 billion related to the equity-funded acquisition of Grubhub in 2021. The impairment was due to the reduction in sector valuation comparables and the impact of increases in interest rates and equity volatility on technical valuation metrics. The Loss excluding the impact of the impairment amounted to EUR 500 million in H1 2022, compared with EUR 486 million in H1 2021.

Outlook

- Management confirms its guidance for FY 2022:

- GTV to grow by mid-single digit year-on-year in 2022

- 2022 Adjusted Ebitda margin in the range of minus 0.5 percent to minus 0.7 percent of GTV

- Management expects to reach positive Adjusted Ebitda in FY 2023, and the long-term objectives for the Company also remain unchanged.

- The Company, together with its advisors, continues to actively explore the partial or full sale of Grubhub. Management reiterates its intention to monetise its 33 percent stake in iFood if an appropriate offer is made that reflects the size and superior growth of this asset. In both cases, there can be no certainty that any agreement with any other parties will be reached or about the timing or terms of any such agreement(s). Any further announcements will be made as and when appropriate.

OTHER TOPICS FROM THIS SECTION FOR YOU:

- LG Chem and ADM: Joint Ventures in Illinois are canceled

- Wendy’s: Company plans to expand into Europe

- Delivery Hero: may face significant fine due to antitrust violations

- Emmi Group: intends to acquire Mademoiselle Desserts

- AB Foods: announces strong H1-2024 performance

- DSM-Firmenich: Queen Maxima inaugurates new dual head office

- RBI: Announces Investments to Drive Growth in China

- Europastry S.A.: puts its IPO process on hold

- McCormick: Reports Second Quarter Performance

- Reborn Coffee: Closes Master License Agreement for UAE

- General Mills: Reports Fiscal 2024 Fourth-Quarter Results

- SunOpta expands plant for processing plant-based beverages

- Britannia: Operating profit grew 10 percent in FY-2023

- Tate + Lyle and CP Kelco to merge to leading global player

- Ülker Bisküvi: announces Q1-2024 financial results

- Europastry: intends to go public on the Spanish stock exchange

- Europastry S.A.: publishes 2023 Annual Report

- Swisslog: announces new Americas region headquarters

- Reborn Coffee: Expanding Omni-Channel Strategy

- Mondelez International and Lotus Bakeries Join Forces