Berlin / DE. (hf) HelloFresh SE released its results for the FY-2023 and the fourth quarter of 2023. In 2023 the Group delivered over 1bn meals to its customers in 18 countries. In its fifth consecutive year of profitable growth, the HelloFresh Group managed to deliver around four times as many meals as in 2019. In terms of consolidated revenue HelloFresh reached approximately EUR 7.6 billion, a y-o-y constant currency growth of approximately 3 percent (FY-2022: EUR 7.6 billion).

Revenue expansion was driven on the one hand by a strongly growing and profitable Ready-to-Eat (RTE) business, reaching EUR 1.4 billion of revenue for FY-2023. On the other hand, the Company expanded its average order value (AOV) in Q4-2023 to EUR 65.0 (Q4-2022: EUR 63.7; +6.4 percent constant currency growth). Primarily due to productivity gains across the Company’s fulfillment operations, the contribution margin expanded by approximately 130 bps to 26.9 percent for the full year 2023 (FY-2022: 25.5 percent), despite previously flagged RTE ramp-up, and other costs in Q4-2023. The AEbitda (= Adjusted Ebitda) of the HelloFresh Group in 2023 amounted to EUR 448 million, in the middle of the revised outlook range provided in November 2023. A strong cash flow from operations allowed the Company to invest further into the business in 2023, e.g. the build out of its RTE production sites, modernization and automation of fulfillment operations and launching new verticals, such as the human-grade pet food brand The Pets Table, that will allow HelloFresh to diversify its revenue streams. Given the Company is already well advanced through its multi-year investment program, capital expenditure in 2023 has decreased by EUR 112 million compared to FY-2022. As a consequence, the Company returned to a positive free cash flow (FCF) of EUR 78 million with Q4-2023 contributing meaningfully with EUR 33 million.

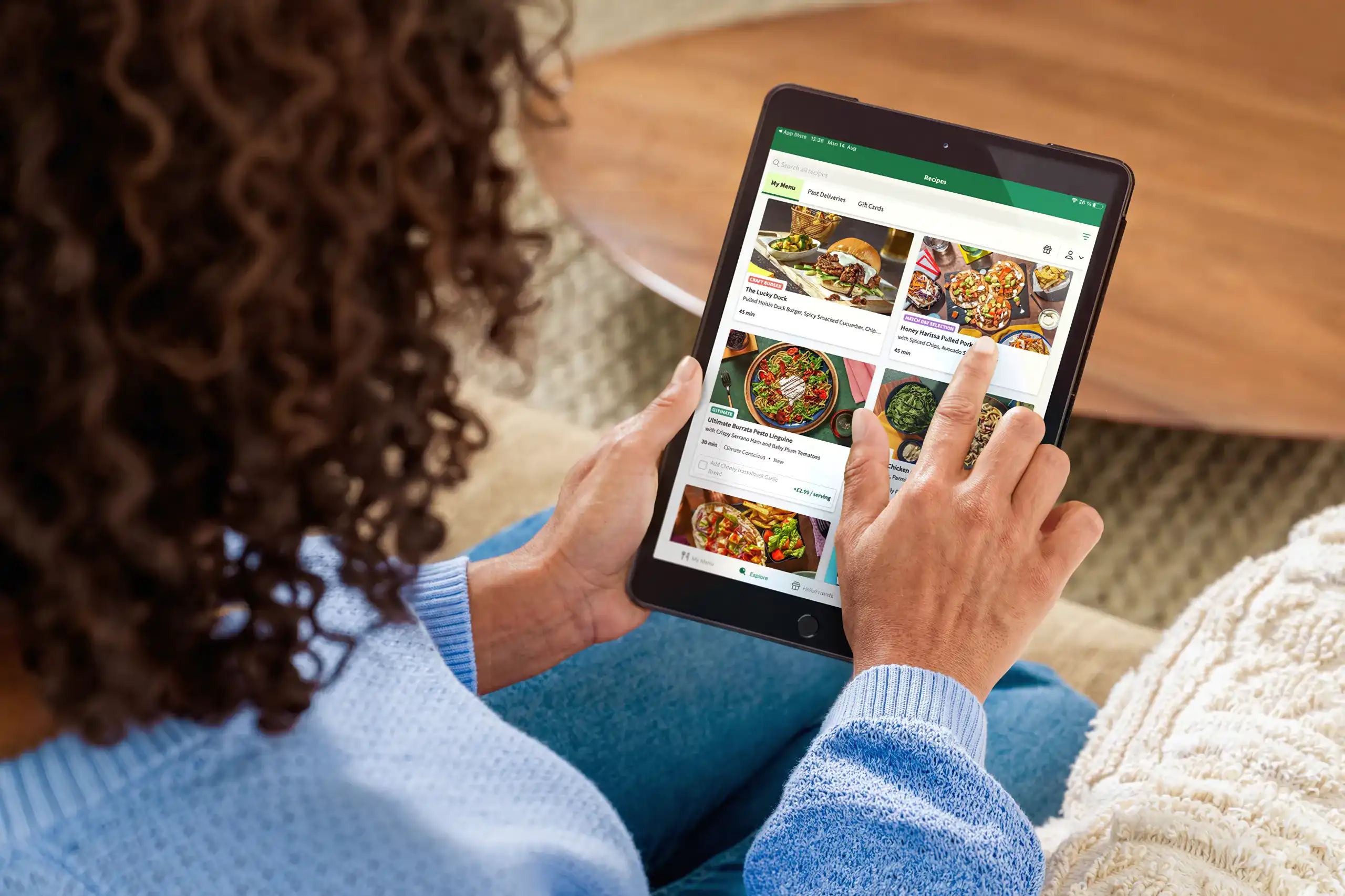

(Photo: HelloFresh Group)

(Photo: HelloFresh Group)

Co-founder and Chief Executive Officer Dominik Richter: «In 2023 we successfully laid the supply chain foundations to significantly scale our RTE vertical over the next several years. We expect continued strong growth for our RTE brand Factor in 2024 and we are preparing to launch Factor in further European countries this year, starting with the Nordics. In our meal kit business we have seen strong improvements in key customer KPIs, driving Customer Lifetime Revenue to the highest levels we ever achieved. We will continue to strengthen our customer proposition in order to return to sustainable growth for our meal kit vertical in the mid-term.»

With the goal of offering a more desirable product and customer experience to meal kit and RTE customers, HelloFresh will continue to improve service levels, launch more flexible delivery options and an assortment with more breadth, both within the menu and in the HelloFresh Marketplace. A loyalty rewards program will be rolled out in certain geographies later this year.

Key figures – Results of operations – Net assets and financial position

20240325-HELLOFRESH-ENOutlook for the current financial year 2024

The Company is targeting for 2024 a constant currency revenue growth of the HelloFresh Group between two and eight percent, driven by a broadly stable number of orders at the midpoint of the revenue growth guidance combined with modestly expanding AOV, driven by a higher share of RTE in the revenue mix. The Group expects its North America (NA) segment revenue to grow at a higher rate than its International segment, driven by the higher share of RTE of total NA revenue. Within RTE the Group expects to continue capitalizing on strong demand, as the Company continues to ramp-up production capacity. For meal kits, the Group expects to close the volume and revenue gap compared to the corresponding period in 2023, as it progresses through the year. The Group expects its ongoing investment into its physical and digital product to contribute to this trend, as well as increasingly easier prior year comparative figures.

From a profitability perspective the Company expects an AEbitda for 2024 below the level reached in 2023, i.e. between EUR 350 million and EUR 400 million on Group level. This is primarily driven by: on the RTE side the continued ramp up of the Company’s production capacity and elevated marketing expenses, given the strong growth in number of orders; on the meal kit side: (i) some fixed cost deleveraging impact due to lower volume, (ii) the ramp-up of two key new fulfillment centers in the Company’s two largest markets within the International segment (United Kingdom and Germany/Austria), which from the fiscal year 2025 onwards are expected to deliver attractive efficiencies and (iii) further product investments.

OTHER TOPICS FROM THIS SECTION FOR YOU:

- LG Chem and ADM: Joint Ventures in Illinois are canceled

- Wendy’s: Company plans to expand into Europe

- Delivery Hero: may face significant fine due to antitrust violations

- Emmi Group: intends to acquire Mademoiselle Desserts

- AB Foods: announces strong H1-2024 performance

- DSM-Firmenich: Queen Maxima inaugurates new dual head office

- RBI: Announces Investments to Drive Growth in China

- Europastry S.A.: puts its IPO process on hold

- McCormick: Reports Second Quarter Performance

- Reborn Coffee: Closes Master License Agreement for UAE

- General Mills: Reports Fiscal 2024 Fourth-Quarter Results

- SunOpta expands plant for processing plant-based beverages

- Britannia: Operating profit grew 10 percent in FY-2023

- Tate + Lyle and CP Kelco to merge to leading global player

- Ülker Bisküvi: announces Q1-2024 financial results

- Europastry: intends to go public on the Spanish stock exchange

- Europastry S.A.: publishes 2023 Annual Report

- Swisslog: announces new Americas region headquarters

- Reborn Coffee: Expanding Omni-Channel Strategy

- Mondelez International and Lotus Bakeries Join Forces