Essen (Ruhr) / DE. (bag) Germany’s Brenntag SE, the global market leader in chemicals and ingredients distribution, presented financial results for the first quarter 2024 below the Group’s ambitions. Brenntag’s performance in both divisions was impacted by a challenging market environment as well as pricing pressures in various markets and industries. The encouraging sequential recovery of volumes, especially in the Essentials division, could not fully offset the lower sales prices, as expected.

Chief Executive Officer Christian Kohlpaintner: «Although our resilient business model with its global reach and broad portfolio enabled us to capture business opportunities, we are not satisfied with our performance in the first quarter of 2024. The difficult market conditions with geopolitical tensions and continuing inflationary trends led to pricing pressures and lower than expected demand in certain markets which adversely impacted Brenntag’s results in both divisions. However, we are cautiously optimistic on the further course of 2024 with volumes showing an encouraging sequential recovery across most regions and industries. Despite the headwinds and the challenging environment, we remain fully committed to implementing our ‘Strategy to Win’ while prudently managing our cost base and driving efficiency in our organization.»

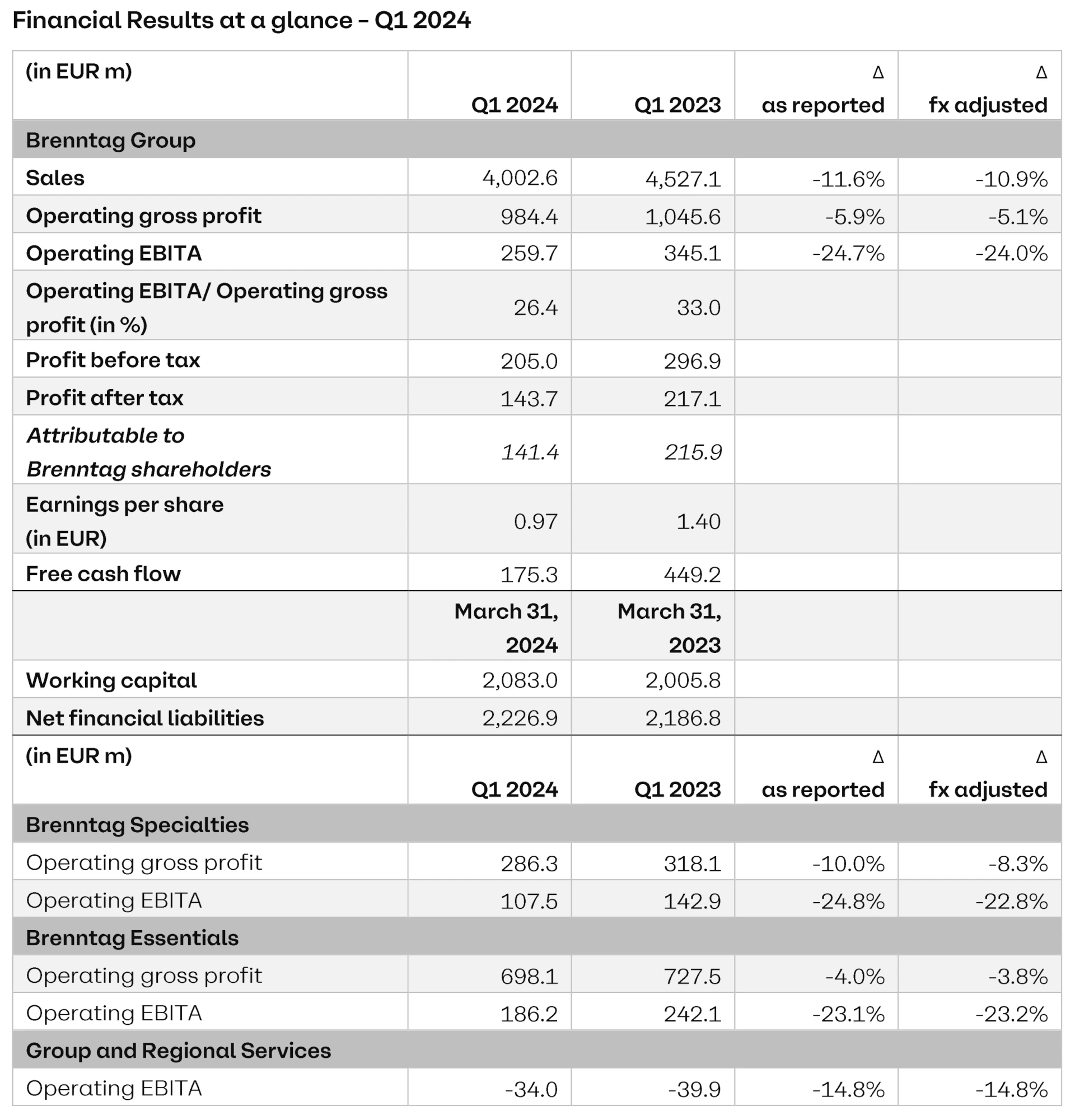

Financial Performance

In the first quarter 2024, Brenntag generated sales of 4,002.6 million EUR which is -10.9 percent compared to the previous year’s quarter. The decrease in sales is mainly attributable to lower sales prices, which could not be fully offset by increased volumes. Operating gross profit declined by 5.1 percent to 984.4 million EUR. Operating Ebita came in at 259.7 million EUR, a year-on-year decline of 24.0 percent. Earnings per share stood at 0.97 EUR (Q1 2023: 1.40 EUR). Due to the earnings’ development and additional funds tied up in working capital, Brenntag’s free cash flow decreased to 175.3 million EUR in Q1 2024. Working capital increased to 2,083.0 million EUR with a working capital turn of 7.9 times (Q1 2023: 7.2, FY 2023: 7.3).

Both divisions below prior year

The decline in Brenntag’s earnings in the first quarter 2024 originated in both divisions, Brenntag Specialties and Brenntag Essentials. Their performance was impacted by a decrease of operating gross profit per unit and cost increases.

Brenntag Specialties reached an operating gross profit of 286.3 million EUR (-8.3 percent). While volumes almost reached the previous year’s level, operating gross profit per unit declined. Operating Ebita decreased by 22.8 percent to 107.5 million EUR. The decline in performance was visible in all segments of Life Science and Material Science. Nevertheless, the slight increase in volumes and the slight sequential improvements in operating gross profit per unit continued compared to Q4 2023. In the newly defined portfolio of Brenntag Specialties, Life Science attributes for around 70 percent of the segment.

Brenntag Essentials saw an encouraging demand development. All segments were able to increase their volumes, both organically and including the new acquisitions. However, the decline in operating gross profit per unit in all segments led to an overall decline in operating gross profit of 3.8 percent to 698.1 million EUR. In the prior year quarter, the division saw a significantly higher price level. Operating Ebita declined on a year-on-year basis by 23.2 percent to 186.2 million EUR. This was partly due to the decline in operating gross profit in the EMEA, North America and Latin America segments, which experienced volume-related increases in transportation costs. In APAC, the decrease in operating gross profit per unit was more than offset by higher volumes – both on an organic basis and including the new acquisitions – as a result of which the segment achieved growth in operating gross profit.

Chief Financial Officer Kristin Neumann: «In the first quarter, we were not able to capitalize on the sequential recovery of volumes and to fully offset the lower sales prices. We have a clear set of measures and a high level of discipline across all levels in our organization to return to our outlined growth and profitability trajectory. To reduce costs, increase efficiency and counteract inflation-driven cost increases we are taking various initiatives that have already shown effects.»

Consistent implementation of «Strategy to Win»

In Q1-2024, Brenntag continued to drive the implementation of its «Strategy to Win« to lay the ground for accelerated growth in the future. One core element of this strategy is sharpening the profiles of the two Brenntag divisions to align them more closely with global market requirements and customer and supplier needs. Since the beginning of 2024, Brenntag has dedicated teams appointed to detail and initiate the next steps in the legal and operational disentanglement of Brenntag Essentials and Brenntag Specialties to make them more independent and autonomous. This is progressing well and according to plans.

In driving its «Strategy to Win», Brenntag also follows a consistent sustainability agenda, the transformation into a stronger data- and technology-driven company, and value-creating M+A activities. In the first quarter 2024, the company strengthened key focus industries and geographies with acquisitions in both divisions. At the end of March, Brenntag Specialties signed and closed the acquisition of Lawrence Industries, significantly expanding the Material Science footprint in the UK and in EMEA. In February, Brenntag Essentials strengthened its «triple» business strategy with the acquisition of Rental Service Specialty LLC in the USA, a provider of specialty rental equipment for the midstream and downstream oil and gas industry. Thus, Brenntag Essentials increases its regional footprint and market presence in the important North American energy sector.

Guidance specified

Brenntag expects the overall geopolitical, macroeconomic, and operational conditions to remain challenging in 2024. However, Brenntag is cautiously optimistic that market conditions will improve throughout 2024, with the first half of the year being more challenging than the second. Brenntag assumes that the sequential recovery of volumes experienced throughout 2023 and which was also observed in Q1 2024 will continue in the following quarters and that the company will benefit from this with higher volumes. In light of these expectations, Brenntag specifies its guidance given in March and expects Brenntag Group’s operating Ebita for the financial year 2024 to be at the lower end of the communicated range between 1,230 million EUR and 1,430 million EUR.

(Table: Brenntag SE)

OTHER TOPICS FROM THIS SECTION FOR YOU:

- LG Chem and ADM: Joint Ventures in Illinois are canceled

- Wendy’s: Company plans to expand into Europe

- Delivery Hero: may face significant fine due to antitrust violations

- Emmi Group: intends to acquire Mademoiselle Desserts

- AB Foods: announces strong H1-2024 performance

- DSM-Firmenich: Queen Maxima inaugurates new dual head office

- RBI: Announces Investments to Drive Growth in China

- Europastry S.A.: puts its IPO process on hold

- McCormick: Reports Second Quarter Performance

- Reborn Coffee: Closes Master License Agreement for UAE

- General Mills: Reports Fiscal 2024 Fourth-Quarter Results

- SunOpta expands plant for processing plant-based beverages

- Britannia: Operating profit grew 10 percent in FY-2023

- Tate + Lyle and CP Kelco to merge to leading global player

- Ülker Bisküvi: announces Q1-2024 financial results

- Europastry: intends to go public on the Spanish stock exchange

- Europastry S.A.: publishes 2023 Annual Report

- Swisslog: announces new Americas region headquarters

- Reborn Coffee: Expanding Omni-Channel Strategy

- Mondelez International and Lotus Bakeries Join Forces