Bolton / UK. (eb) British Warburtons Limited announced its audited financial statements for the 53 week period ended 30 September 2023. According to the bakery, part of the family-owned Warburtons 1876 Limited Group, the wrapped bakery market remains very competitive, with the underlying long-term declines in the core bread market continuing to be offset by growth in other wrapped bakery products.

The ongoing war in Ukraine continued to have a significant impact on the business, particularly throughout H1-2023. Global markets and commodity prices continued to be impacted. As a result, the company continued to see inflationary increases in costs across key areas including wheat, energy, and fuel. The company continued to monitor these costs and ensure that appropriate strategies were put into place.

The cost-of-living crisis across the UK continued to impact the market. The company balanced the recovery of input cost inflation with strong cost management, maintaining product quality and brand investment, as well as offering its consumers competitive prices. Volumes remained strong during the period driven by strategic customer partnerships and new product introductions, supporting a 17.4 percent increase in turnover. The company continues to monitor the impact of inflationary pressures on the business.

The company continues to focus on the quality of products and services, supported by the ongoing development of new product ranges. Investment is focused on enhancing the company’s capability to meet changing consumer trends and deliver productivity. This continuing innovation and investment in new capability will ensure the company is well placed for future progress.

Results and financial performance

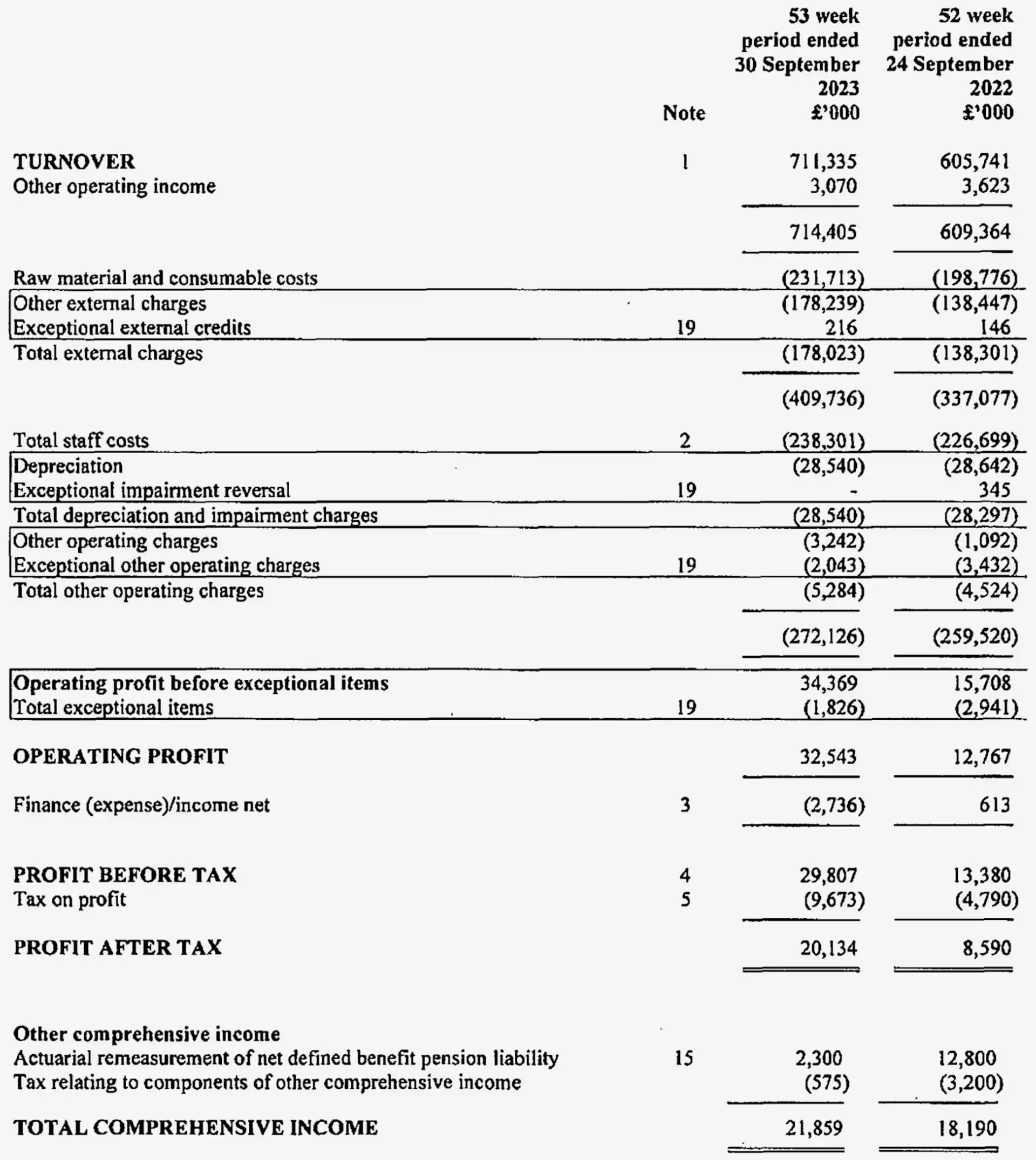

- The results of Warburtons Limited for the current financial period covers a period of 53 weeks (2022: 52 weeks).

- The turnover of GBP 711.3 million for the period (2022: GBP 605.7 million) represented an increase of 17.4 percent.

- The company has recorded an operating profit of GBP 32.5 million (2022: GBP 12.8 million). Profit in the period has increased as a result of increased turnover and improved margins.

- Profit before tax was GBP 29.8 million (2022: profit before tax of GBP 13.4 million).

- Fixed asset additions totalled GBP 18.9 million (2022: GBP 29.6 million) for the period.

- The average number of employees during the period was 4’952 (2022: 4’906 employees).

The Company is a private, family-owned business in fifth generation. During the course of the financial period, the Board of Warburtons Limited was comprised of two non-executive directors (Andrew Higginson and Mary-Ann Kilby), one executive director (Andrew Light) and three family executive directors (Jonathan Warburton, Ross Warburton and Brett Warburton). The family directors indirectly represent the majority shareholding in Warburtons 1876 Limited. Members of that Company are therefore directly represented on the Board of most companies within the Group. The family Board directors are directly invested in promoting the success of the Warburtons Group for the benefit of the members as a whole (including other family members). With effect from 2023/09/01 Mary-Ann Kilby became Managing Director of Warburtons Limited and on 2023/09/25, Higginson resigned as a director. With effect from the end of September there were no non-executive directors and an active search commenced to replace these vacancies.

(Table: Warburtons Limited – Financial statements for the 53 week period ended 30 September 2023 – page 20)

OTHER TOPICS FROM THIS SECTION FOR YOU:

- Arcos Dorados: Reports Q2-2024 Financial Results

- Ark Restaurants: Announces Q3-2024 Financial Results

- Utz: acquires distribution rights from National Food Corp

- Tide Rock LLC: Acquires Glenn Wayne Wholesale Bakery

- Portos Bakery + Cafe to Enhance Digital Ordering Experience

- GrubMarket: Acquires Good Eggs Grocery Company

- Conagra Brands: Acquires Sweetwood Smoke Company

- The Andersons: Reports Second Quarter 2024 Results

- Instacart: Announces Q2-2024 Shareholder Letter

- Toast Inc.: Announces Q2-2024 Financial Results

- WK Kellogg: announces Q2-2024 financial results

- Yum China: Reports Second Quarter 2024 Results

- Utz Brands: Reports Second Quarter 2024 Results

- Post Holdings: Reports Third Quarter 2024 Results

- DoorDash: Releases Q2-2024 Financial Results

- DPC Dash: Issues Positive H1-2024 Profit Alert

- GrubMarket: Acquires Best Oriental Produce

- LDC Managers: exits Hill Biscuits to Cerealto UK

- Luckin Coffee: Announces Q2-2024 Financial Results

- Greggs PLC: announces preliminary results H1-2024