Barcelona / ES. (ep) Spanish Europastry S.A., a fast-growing specialist pioneer in premium quality frozen bakery products and a top-five player in the global frozen bakery market segment, with over EUR 1.3 billion of net turnover in 2023, announces its intention to proceed with an initial public offering (IPO) of its ordinary shares to qualified investors. The Company intends to apply for admission of the Shares to listing on the Spanish stock exchanges of Barcelona, Madrid, Bilbao and Valencia for trading through the Automated Quotation System (Mercado Continuo). The Offering is expected to comprise a primary offering of newly issued Shares by the Company in an amount of approximately EUR 225 million and a secondary offering of existing Shares made by Exponent S.à r.l., controlled by MCH Continuation Fund, Gallés Office, S.L., owned by the Gallés family and which will remain as a controlling shareholder post-IPO, and Indinura, S.L., controlled by Europastry’s Chief Executive Officer, Jordi Morral (collectively, the «Selling Shareholders»). The Offering will be made to qualified investors, including a placement in the United States to qualified institutional buyers under Rule 144A.

Jordi Gallés, Executive President and (through Gallés Office, S.L.) majority shareholder of the Company said: «Europastry is at the next stage of its development, and this IPO is the natural way to fund and accelerate our growth strategy to foster our leadership position in the frozen bakery segment while deleveraging and maintaining a prudent capital structure. Through international expansion, continued product innovations and a value-accretive acquisitions strategy we want to cement our position as a leader in the global frozen bakery market and promote sustainability in the sector. We are excited about our future as a listed company.»

Europastry, A Specialist In Premium Quality Frozen Bakery Products

Europastry, founded in 1987 by Pere Gallés, is a family-owned leading global player in the frozen bakery market. Headquartered in Barcelona, it operates worldwide across more than 80 countries with 27 production centers. The Company is focused exclusively on frozen products, differentiating itself through innovation and an expanding international footprint.

- A leading global pure player: Specialist and pioneer in quality frozen bakery products, the leading supplier of frozen bakery products in Spain, with a 27 percent market share in Spain 1, and among the top-five players in the global frozen bakery market segment, based on 2022 net turnover.

- Present in the fastest-growing segment of the bakery market: The frozen bakery market is expected to grow at a 6.5 percent CAGR in terms of revenue between 2021-26E in the geographies in which Europastry primarily operates, according to industry sources. The market tailwinds are mainly driven by: a) favourable structural customer trends, such as the preference for natural quality products, as well as, the reduction of business complexity with less waste, less personnel and less required know-how, driving the substitution of fresh products for frozen products; and b) the frozen bakery market benefits from a higher exposure to foodservice and traditional bakery customer channels, which are expected to grow faster than retail customer channels. As a result, between 2021-26E, the frozen bread and pastry market segment’s share of the total bakery market is expected to continue growing, in terms of volume, in the geographies in which Europastry primarily operates, according to industry sources.

- Wide and innovative premium product offering: Europastry’s strong focus on R+D and outstanding know-how, combining artisanal and traditional bakery processes with modern technology, has led to a wide product offering of over 4,900 stock-keeping units (SKUs) in quality frozen products across pastries (56 percent of 2023 net turnover), breads (42 percent) and other products (2 percent).

- Industry-leading innovation capabilities: Europastry’s strong capabilities in innovation and product customization allow it to quickly adapt to market trends, create solid entry barriers, increase client retention and switching costs. Europastry’s innovation process, which from the idea stage to industrial production typically takes 9 to 12 months, is done through six R+D facilities (Centers for Research Europastry Advanced Labs or «CEREALs»), which helped to launch more than 480 new products launched in 2023.

- Diversified and long-standing customer base: Europastry serves a diversified B-2-B customer base which includes (a) retailers (approximately 56 percent of 2023 net turnover), (b) foodservice customers (approximately 32 percent), (c) traditional bakery customers (approximately 11 percent), and (d) other manufacturer customers (approximately 2 percent). The business structure efficiently services this well- diversified customer base, with Europastry’s top 20 customers representing approximately 38 percent of net turnover in 2023, across five continents, with a tailored offering that meets changing end-market preferences, both directly and through over 650 third-party distributors to over 80,000 customer points of sale.

- Well-invested industrial footprint: The Company’s leadership lies in its integrated production and supply model that includes 27 production centers with a total of 97 production lines across seven countries and, in 2023, more than 1,000 raw materials suppliers.

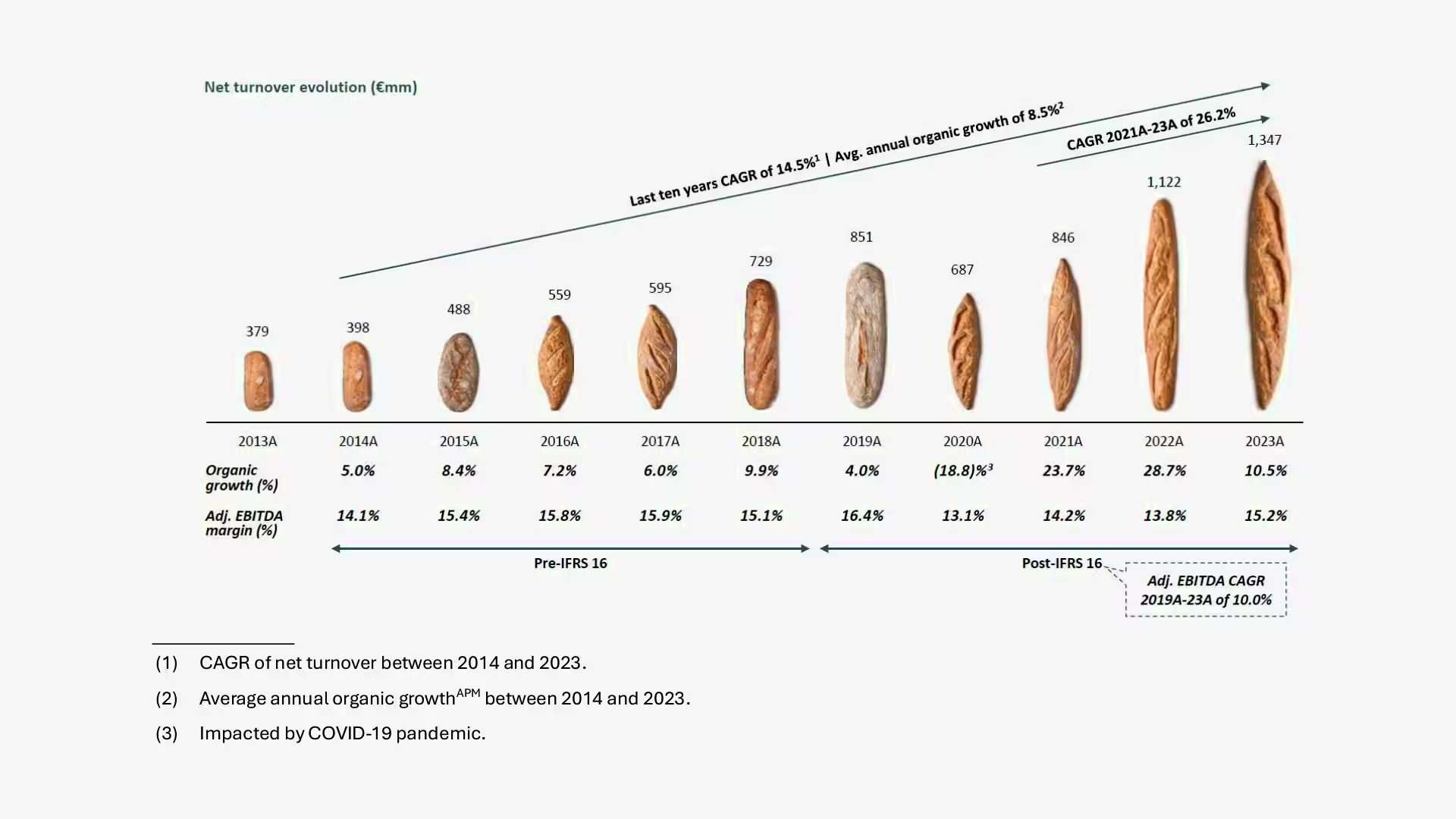

- Fast-growing operations through organic and inorganic growth: The Company has invested significantly to grow organically through innovation and the development of new production centers and lines. Between 2014 and 2023, the Company has delivered an annual average of 8.5 percent organic growthAPM3. Growth has also been driven by targeted value-accretive acquisitions of smaller frozen bakery competitors in Europe, the United States and Mexico, helping to drive a 14.5 percent net turnover growth CAGR between 2014 and 2023.

- Experienced management team with a clear strategy to deliver profitable growth: We believe Europastry’s experienced and multidisciplinary management team, supported by strong family values, has demonstrated its capability by creating and developing a company with leading market positions, a continuously evolving and innovative product portfolio, successful international operations, a strong track record of acquisitions and a solid financial performance.

Long History Of Growth, Profitability And Strategic Cash Flow Reinvestment

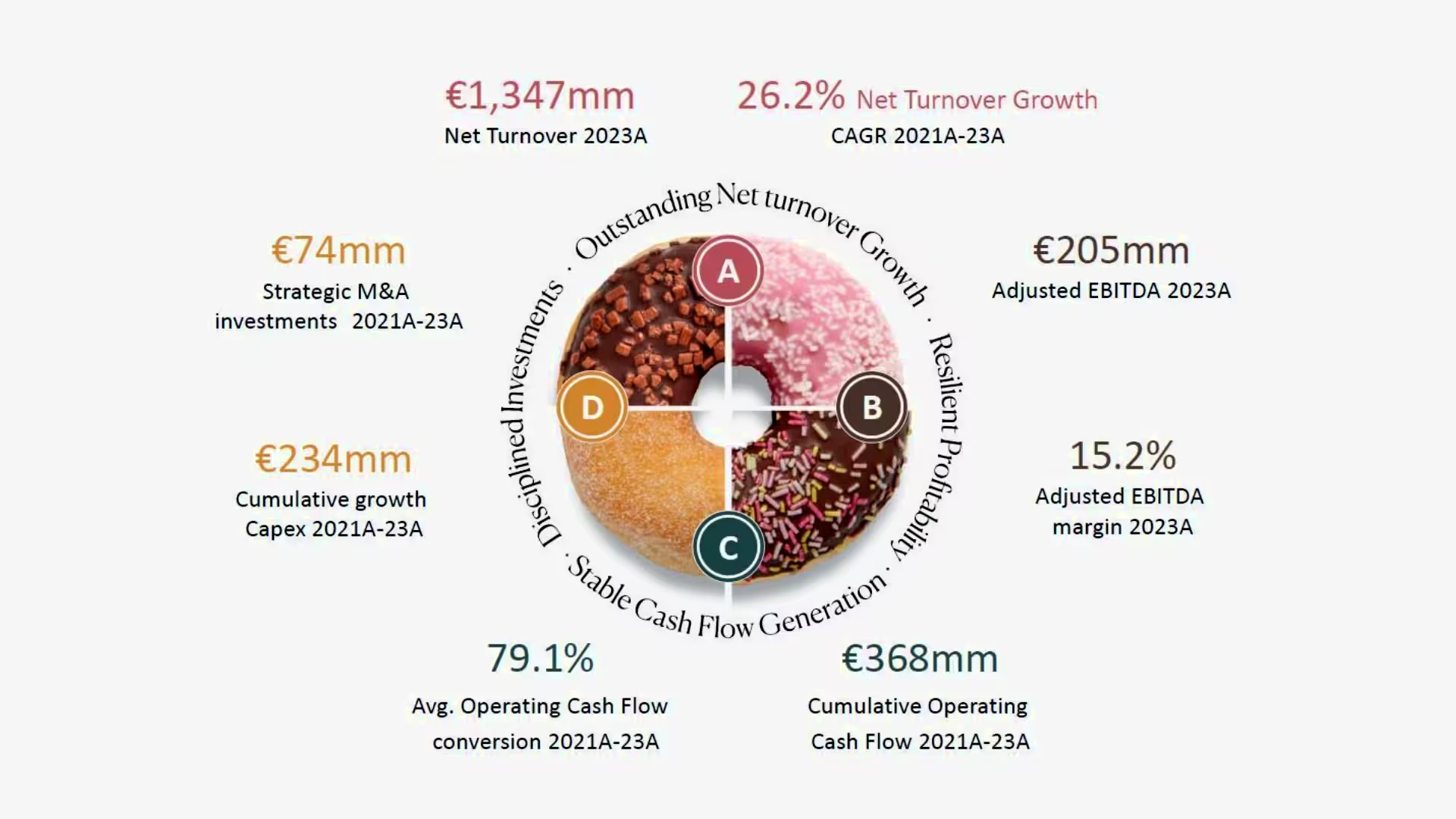

- For the three months ended March 31 (Q1-2024), the Company achieved net turnover of over EUR 325 million and adjusted EBITDAAPM of over EUR 47 million.

(Graphics: Europastry S.A.) - Europastry is targeting net turnover growth for 2024, in percentage terms, of low-to-mid teens (including the impact of its March 2024 acquisition of DeWi Back Holding GmbH) and will target high single digit average organic growthAPM for 2025 onwards, in line with average historical organic growth. In the medium term, Europastry expects its adjusted EBITDA marginAPM to slightly increase relative to 2023 levels, driven by product mix and operational leverage, diversification of distribution channels, the phase out of ramp-up costs from growth investments, the crystallization of synergies from recent acquisitions and improved profitability from the international (ex-Europe) segment.

(Graphics: Europastry S.A.)

Proposed Offering Highlights

- The Offering is expected to comprise a primary offering of newly issued Shares of the Company in an amount of approximately EUR 225m to help de-leverage and potentially take advantage of organic and inorganic growth opportunities that Europastry may come across in the short or medium term.

- The Offering is also expected to comprise a secondary component by the Selling Shareholders, with the Gallés family (through Gallés Office, S.L.) remaining as a controlling shareholder post IPO.

- An over-allotment option expected to be granted by Gallés Office, S.L. and the Company over up to 10 percent of the size of the Offering.

- Expected post-IPO free float will be at least 25 percent, in compliance with applicable regulations.

- J.P. Morgan SE, UBS Europe SE and ING Bank N.V. are acting as Joint Global Coordinators and Joint Bookrunners for the Offering (the «Joint Global Coordinators»). Banco Santander, S.A., CaixaBank, S.A., Banco Bilbao Vizcaya Argentaria, S.A. (in collaboration with ODDO BHF) and Coöperatieve Rabobank U.A. are acting as Joint Bookrunners (together with the Joint Global Coordinators, the «Joint Bookrunners»). Banca March, S.A., Mirabaud Securities Limited, Sucursal en España and JB Capital Markets Sociedad de Valores, S.A. are acting as Co-Lead Managers (the «Co-Lead Managers» and together with the Joint Bookrunners, the «Managers»). Cuatrecasas, Gonçalves Pereira, S.L.P. and Davis Polk + Wardwell LLP are acting as legal counsel of the Company and J+A Garrigues, S.L.P. and Linklaters, S.L.P. are acting as the Managers’ legal counsels.

Further details of the proposed Offering will be included in the Prospectus (the «Prospectus») to be approved by, and registered with, the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores, the «CNMV») in connection with the Offering and the Admission, and which will supersede this announcement in its entirety. The Prospectus approval process is ongoing, and The Prospectus will include full details on the Offering and its expected timetable. Once approved, the Prospectus will be published and made available on the Company’s website and at the CNMV’s website.

Any acquisition of Shares in the Company should be made solely on the basis of the Prospectus approved by, and registered with, the CNMV. The approval of the Prospectus by the CNMV does not constitute an evaluation of the merits of the Offering.

OTHER TOPICS FROM THIS SECTION FOR YOU:

- LG Chem and ADM: Joint Ventures in Illinois are canceled

- Wendy’s: Company plans to expand into Europe

- Delivery Hero: may face significant fine due to antitrust violations

- Emmi Group: intends to acquire Mademoiselle Desserts

- AB Foods: announces strong H1-2024 performance

- DSM-Firmenich: Queen Maxima inaugurates new dual head office

- RBI: Announces Investments to Drive Growth in China

- Europastry S.A.: puts its IPO process on hold

- McCormick: Reports Second Quarter Performance

- Reborn Coffee: Closes Master License Agreement for UAE

- General Mills: Reports Fiscal 2024 Fourth-Quarter Results

- SunOpta expands plant for processing plant-based beverages

- Britannia: Operating profit grew 10 percent in FY-2023

- Tate + Lyle and CP Kelco to merge to leading global player

- Ülker Bisküvi: announces Q1-2024 financial results

- Europastry S.A.: publishes 2023 Annual Report

- Swisslog: announces new Americas region headquarters

- Reborn Coffee: Expanding Omni-Channel Strategy

- Mondelez International and Lotus Bakeries Join Forces

- La Lorraine: completes new joint venture in the USA