Essen (Ruhr) / DE. (bag) Germany’s Brenntag SE, the global market leader in chemicals and ingredients distribution, presented second quarter 2024 financial results in line with market expectations but below its own ambition level, reflecting an overall weaker than anticipated H1 2024. The performance was impacted by the overall challenging business environment, characterized by strong competition and continued pressure on chemical selling prices in various end markets. The sequential quarter-by-quarter performance in both divisions, Brenntag Specialties and Brenntag Essentials, showed encouraging improvements, including sequential volume recovery and stable gross profit per unit thanks to various pricing initiatives. As a result, the Group’s Q2 operating Ebita improved sequentially.

Chief Executive Officer Christian Kohlpaintner: In the challenging markets of the second quarter of 2024, we saw encouraging trends and positive developments. Our sequential volume recovery quarter by quarter materialized as predicted. We were able to keep gross profit per unit stable compared to the first quarter. This is a clear success of our commercial teams to manage margins effectively in an intensive competitive business environment. In addition, our various measures to achieve efficiencies and reduce costs continue to show effect. However, our overall performance in the first half of 2024 is unsatisfactory and below our ambition. In addition, the overall trends and chemical industry expectations observed recently make us more cautious for the remainder of the year. We expect a less supportive volume development and sustained price pressure in industrial chemicals. Thus, we need to and will accelerate our efforts, focus on driving business performance, and will execute a strong and prioritized cost take-out across our organization to meet our business and financial targets. Looking beyond 2024, we expect that the currently observed sequential improvement in demand will continue in 2025 based on the general recovery of the chemical cycle combined with an improved pricing environment.»

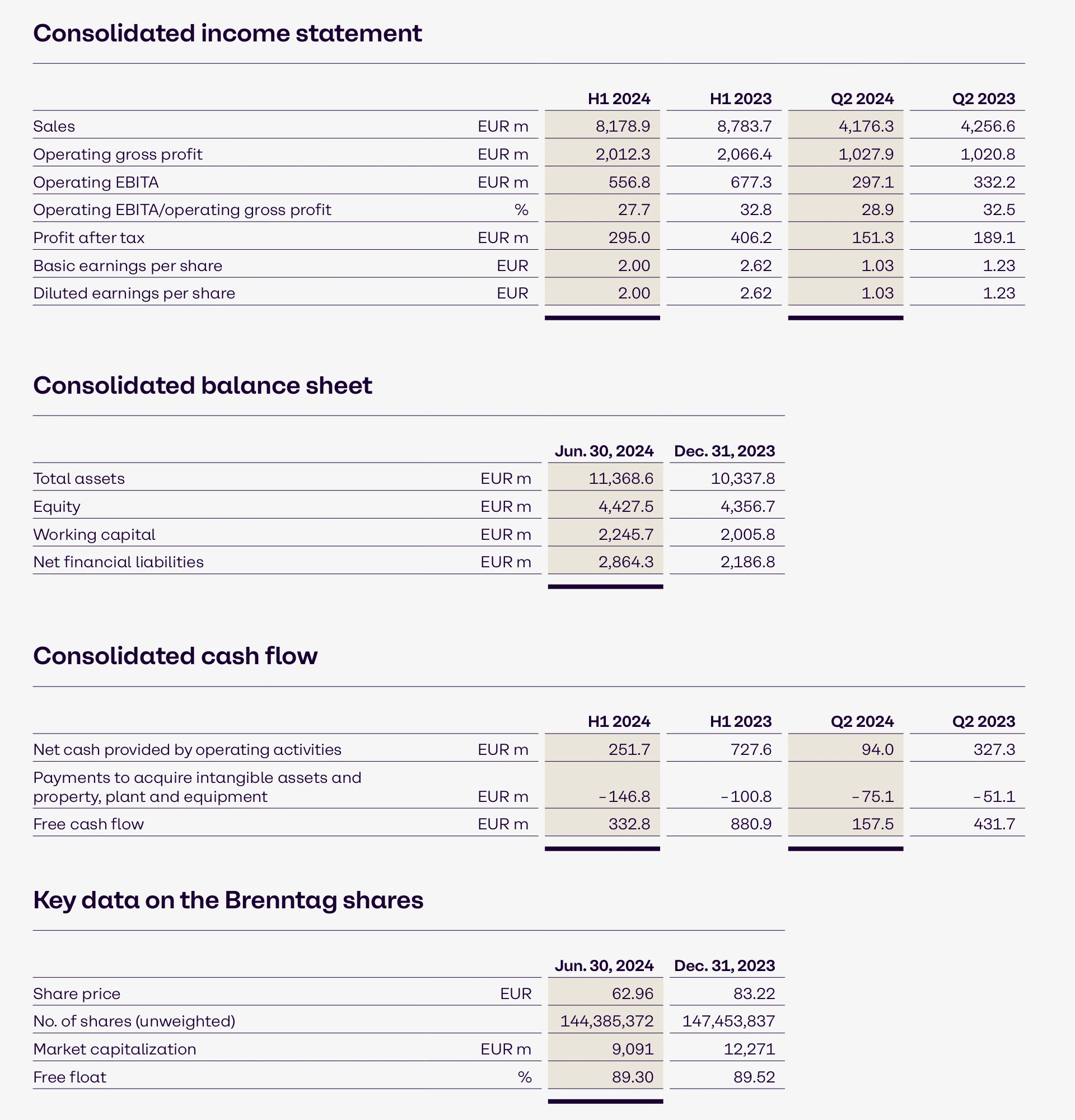

Financial Performance

In the second quarter 2024, Brenntag reached sales of 4,176.3 million EUR (-2.0 percent). Despite lower sales, operating gross profit could be kept stable on prior-year level with 1,027.9 million EUR (+0.6 percent). Brenntag achieved an operating Ebita of EUR 297.1 million, a year-on-year decline of 10.4 percent. The higher volumes did not compensate the lower year-on-year gross profit per unit margins in combination with slightly higher costs. Earnings per share were 1.03 EUR (Q2 2023: 1.23 EUR). Working capital increased to 2,245.7 million EUR with a working capital turn of 7.8 times, which is substantially better than last year’s turn (Q2 2023: 7.2). The combination of the year-over-year weaker results and higher investments into working capital led to a free cash flow of 157.5 million EUR in Q2 2024.

Both divisions with encouraging improvements

The sequential quarter-by-quarter performance in both Brenntag divisions showed encouraging improvements compared to the first quarter of 2024. However, Brenntag Specialties and Brenntag Essentials delivered results below Q2 2023 figures and below own ambitions. Volumes are continuing to show a sequential recovery across most regions and industries. In a continuously challenging market environment with intensive competition which puts pressure on overall chemical prices, the business was able to keep gross profit per unit stable compared to the first quarter, thanks to various margin initiatives.

Brenntag Specialties recorded an increase in volumes compared to prior year quarter, while operating gross profit could be kept stable, amounting to 297.5 million EUR (+0.1 percent). Operating Ebita decreased by 12.8 percent and came in at 112.3 million EUR. The year-on-year decline was caused by higher costs, partly driven by M+A and volume related increases in transportation costs. All business units in the Life Science segment except Pharma saw a positive operating gross profit development year-over-year, driven by higher volumes. The Material Science segment showed a considerable sequential improvement in volumes and gross profit was in-line with Q2 2023.

Brenntag Essentials reported an operating gross profit of 730.4 million EUR, slightly above prior-year quarter (+0.8 percent). Operating Ebita declined across all regions and reached 213.8 million EUR (-13.4 percent). All regions increased volumes, both organically and including the acquisitions. This volume development was able to offset lower gross profit per unit in most regions, resulting in a positive operating gross profit development in all segments except EMEA. All segments were negatively impacted by volume-driven increases in transport costs.

Efficiency and cost reduction measures intensified

During its Capital Markets Day 2023, Brenntag announced measures to achieve efficiencies, reduce its operating costs and counteract inflation-related cost increases, with an overall savings target in the amount of 300 million EUR by 2027. In Q2-2024, Brenntag executed further measures to achieve the targets.

Chief Financial Officer Kristin Neumann: «We focus on continuously optimizing our cost base across divisions and business functions. We carefully evaluate all potential levers across the Group. The cost measures announced at our Capital Markets Day are on track and we will continue to focus on our cost development with strict discipline. However, in light of our overall performance in the first half of 2024, we will accelerate and expand our cost-out efforts and initiatives in the remainder of the year. As already announced in Q1, we postpone discretionary spend and stretch IT and DiDEX investments in selected areas over a longer period of time. The measures to reduce operational costs and complexity in our organization also include the continued optimization of our global site network»

Brenntag continues to execute «Strategy to Win»

Despite market headwinds and the challenging environment, Brenntag continued in Q2 2024 to implement its «Strategy to Win» across all four pillars, laying the foundation for accelerated growth in the future. Since the beginning of the year, Brenntag has signed five acquisitions with a total Enterprise Value of around 340 million EUR, strengthening key focus industries and geographies in both divisions. In its key strategic pillar of «Sustainability», the group can report significant achievements: Brenntag again received the EcoVadis Platinum status, the highest possible assessment achievable. Brenntag is now the only chemical distributor with a global platinum rating and among the top 1 percent of companies rated across all industries. Moreover, the company has improved its ISS ESG Corporate Rating to «B-», after being awarded the Prime status with a «C+» rating already last year. The rating indicates a very high transparency level of ESG disclosure as well as industry leading ESG performance. Also here, Brenntag is the only chemical distributor with this rating.

Through decisive and focused measures along a clear transformation plan, Brenntag is sharpening the profiles of Brenntag Specialties and Brenntag Essentials to enhance their value proposition and accelerate growth. The company will continue to increase divisional autonomy and independence, focusing on areas with the highest value creation and differentiating potentials. This means the disentanglement of the customer- and supplier-facing front-end in the divisions. Brenntag also continues with the optimization of its legal entity set-up but as indicated at its Capital Markets Day 2023, the disentanglement of its legal entity structure and its operations will be a longer-term exercise which needs to be carried out prudently.

Guidance adjusted

For the remainder of the year, Brenntag expects the overall geopolitical, macroeconomic, and operating environment to remain challenging. The ongoing tense geopolitical situation and the slowly softening inflation will continue to create uncertainty about growth expectations of the global economy.

Despite the challenging market environment, the company was able to keep its gross profit per unit stable in the second quarter compared to the first quarter of 2024 due to various margin initiatives and achieved sequential volume growth.

However, the market trends and chemical industry expectations observed in recent months, and particularly in July, indicate that markets will remain highly competitive, with sustained pressure on industrial chemical selling prices. Therefore, Brenntag SE does not expect a positive gross profit per unit development in the second half of the year anymore but rather anticipates a more stable development on group level. Additionally, the company also expects a slightly lower than initially anticipated sequential improvement in volumes in the second half of 2024.

Based on these assumptions, Brenntag SE now expects operating Ebita for the financial year 2024 to be in the range of 1.10 billion EUR to 1.20 billion EUR. To reach this guidance, the company will continue to focus on margin management and cost discipline.

Key financial figures at a glance

(Table: Brenntag SE)

OTHER TOPICS FROM THIS SECTION FOR YOU:

- Pret A Manger: Sales rise 10 percent in H1-2024

- General Mills: Sells Its North American Yogurt Business

- HSA Group: acquires majority stake in Bisco-Misr

- One Rock Capital: Plans Acquisition of Europe Snacks

- T.Hasegawa acquires Abelei Flavors

- AB Foods: announces H2-2024 Trading Update

- AB Foods: acquires Australian bakery group

- Pladis Foods: opens regional office in Saudi Arabia

- Hormel Foods: Reports Third Quarter 2024 Results

- Reborn Coffee: Closes Master License Agreement for Sichuan

- Strauss Group: Reports Half-Year 2024 Results

- Grupo Bimbo: Agrees to Acquire Wickbold in Brazil

- Ülker Bisküvi: announces H1-2024 financial results

- Delivery Hero: announces positive H1-2024 results

- Campbell: Reports Q4 and Full-Year Fiscal 2024 Results

- Hain Celestial: Reports Fiscal Q4-2024 Financial Results

- Barry Callebaut: 9-Month Key Sales Figures FY-2023-2024

- Ebro Foods: Net Profit up 17 percent in H1-2024

- Circus Group: Signs Preliminary Agreement With FLC

- DPE Dominos Pizza Enterprises: Reports FY-2024 Results